This too shall pass: why patience is a virtue for investors

Following years of relatively strong returns, 2022 was a reminder that investing can be ‘three steps forwards, one step back’. A long-term outlook and steady nerve are the keys to getting through unsettling times like these.

A wise investor knows this simple truth – you will see the value of your portfolio decline at some point.

They also know this – you will see the value of your portfolio rise at another point.

Throughout the year, stock markets will go up and down. It’s what they do. Take a snapshot one day and you could see you’ve got less than you put in. But look another day (or even another hour) and you’re quids in.

It’s nothing to be alarmed about. History shows that any market volatility is temporary, and should be balanced out over the long term. So long as you’re invested in a well-considered, diversified portfolio, you’ll be ok if you have patience and just let markets do their thing.

Looking back at 2022

For many investors, 2022 was a relatively tough year, with returns ranging from ok to poor across most asset classes. A forty-year high in the cost of living meant lower after-inflation returns, with the biggest impact being on the value of bonds. The best 2022 performers were global ‘value’ stocks (belonging to companies currently undervalued by the market), and many UK investors benefitted from the strong dollar when converting returns back to pounds.

Still, with few places to hide, most investors will have finished the year in negative territory. While unwelcome, this can be expected from time to time. Sensible investors will be working with a much longer time frame than 12 months – ideally a minimum of ten years – so one bad year is unlikely to have a big impact.

Looking even further back

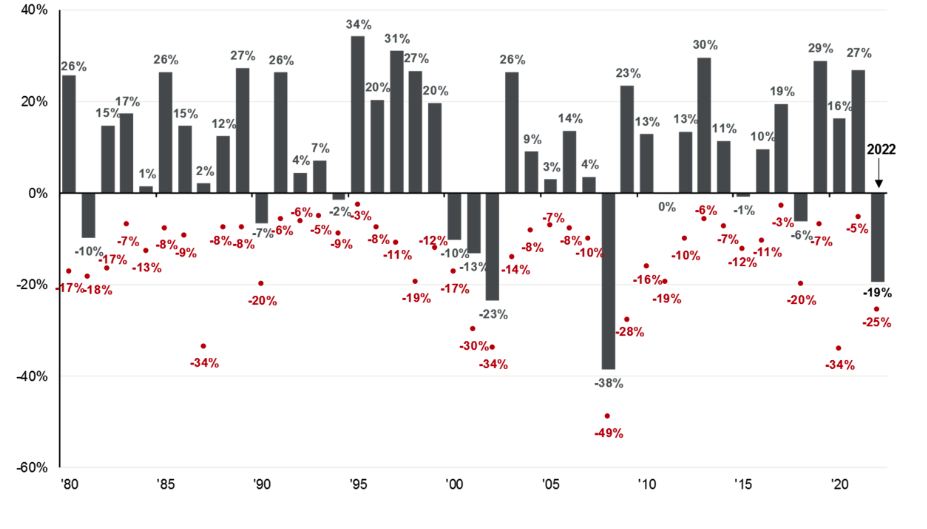

To help illustrate why a long-term view is so important, let’s look at a snapshot of the S&P 500 Index (the largest companies listed in the US). Figure 1 shows how the S&P 500 fared over the last four decades – the grey bars show the overall return for the year and the red dots show the lowest point within that same calendar year.

Figure 1: Annual returns and intra-year declines (the largest market fall from peak to trough in the year) for the S&P 500, 1980–2022

Source: JP Morgan’s Guide to the Markets, US. Data as of 31 December 2022 from: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. For illustrative purposes only. Past performance is not a reliable indicator of current and future results.

Source: JP Morgan’s Guide to the Markets, US. Data as of 31 December 2022 from: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. For illustrative purposes only. Past performance is not a reliable indicator of current and future results.

Over the 42 years, annual returns were positive for 32 of them – over three-quarters of the time. Even when incorporating 2008’s credit crisis slump of -38%, the average return over that period was +9.4% a year, although most years actually enjoyed double figures well above that. However, those positives might be hard to see when experiencing an average low of -14% in a year…

What does this tell us? Context is crucial! The low points may seem bad at the time, but patience will pay off and should provide inflation-beating returns, given a chance to recover.

So when you see the S&P 500 figures for 2022 showing an overall return of -19%, with the biggest drop during the year coming in at -25%, remember to take a wider look. For example, investors in 2020 will have been disheartened by that 34% drop, but the year ended up providing an overall return of +16%.

How many pulled out in a panic and lost out before they got there?

How to be a well-behaved investor

Of course, no portfolio should ever invest in just one asset class or region – diversification will help shield capital from extreme movements in any one area.

If you’re invested in a well-diversified portfolio that matches your appetite for risk, managed by a Financial Planner you can rely on, there’s no reason to veer off-course. The trick is to think long-term and to not keep adjusting your portfolio, or even checking it! Its value will go up and down – as will inflation – so you should expect this and give it time to perform.

The worst thing you can do when markets are down and your portfolio is lagging is react impulsively. Many people who don’t choose to work with a Financial Planner do just this, often lacking the confidence and discipline to hold their nerve. While it’s natural to feel nervous when your money isn’t thriving, if you pull out and sell when markets are low, you’ll miss out on the eventual upside.

Of course, there’s nothing wrong with feeling nervous when times are challenging. At Goodmans, our clients can have peace of mind that our portfolios are robust, with a proven track record of comfortably outperforming inflation over time. Whatever the markets are doing, we’re ready to steer a steady ship so you can you meet your financial goals and look forward to the future with confidence.

If you’d like to book in a financial planning review, contact us.