Uncertainty abounds in markets – it always does

While today’s uncertainty may seem unprecedented, investors have been here before – and markets have always bounced back over time.

Today, it certainly feels like the world is in a very uncertain place. Authoritarian states are flexing their muscles – Russia violating Ukraine’s sovereignty and China’s ongoing subjugation of Hong Kong with the new National Security Law alongside its apparent support for Russia – are two cases in point.

The West continues to struggle with what’s hopefully the back end of the Covid crisis as populations gather immunity through vaccination and infection, and new drugs and treatments come online.

Economically, the greatest challenge is soaring inflation hitting levels not seen for several decades. As a consequence, interest rates and yields on bonds have started to rise and global equity markets have started the year down.

All that can feel both gloomy and unsettling.

It's always easy to feel that the present is more uncertain than the past. We have all but forgotten the Armageddon scenarios of events such as the Y2K software bug issues of 2000 (planes expected to fall out of the sky, nuclear power stations potentially out of control etc), the emotional and geopolitical impact of 9/11, or the fear many felt in 2008 when Lehman Brothers failed and the meltdown of the financial system was a real risk.

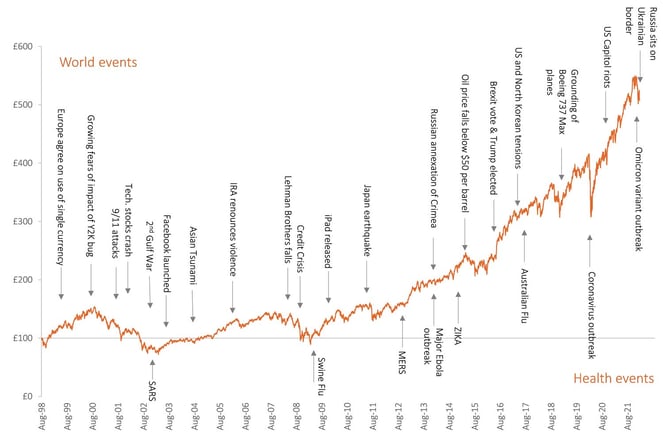

The chart below illustrates that over the mid to longer term, the markets absorb the consequences of such events and power forwards as capitalism drives the relentless pursuit of profit opportunities.

Figure 1: Material global events are ever present

Data source: Vanguard Global Stock Index ACC, 4/8/1998 to 14/2/2022 in GBP used as proxy for the performance of global equities. Its use in this chart does not constitute any form of recommendation and is provided for educational purposes only.

So being shaken out of markets based on the latest news is just about the worst mistake any long-term investor can make.

What’s to be done about the Ukraine situation?

The short answer is ‘not much’. As ever, all the news that we see and worry about – including the invasion of Ukraine by Russia – is already reflected in market prices. New news, as it develops, will have an influence on those prices, but by its very definition this is a random process that is hard to benefit from unless you own a crystal ball. It’s likely that markets will be volatile as events develop. The US market actually rose on the day Russia invaded.

In terms of direct portfolio exposure, it’s worth noting that Russia represents around 0.35% of global equity markets, and that’s before this is diluted down in any portfolio by bond holdings. To put this in perspective, the global market weight of Apple is over 4%! In fact, Apple’s cash reserves alone are of a broadly similar magnitude to Russia’s entire market capitalisation.

No one has any real idea as to the wider impact of the Russian invasion, but even if markets fall, you need to ask yourself the following questions:

- Do you understand that equity markets can go down – sometimes materially – as part of their journey to delivering positive longer-term returns after inflation? If this is a surprise to you, then you need to speak with (or possibly fire!) your adviser.

- Have your financial and personal circumstances changed recently to such an extent that you need immediate liquidity from your equity positions? That is most unlikely. Feeling uncertain about markets is not a valid reason for seeking to get out of markets.

- Do you remember that your high-quality bonds provide several valuable attributes? This includes: 1. more stable values, supporting a portfolio against equity market falls; 2. liquidity to meet any liabilities without having to sell equities when they’re down; 3. the dry powder to rebalance the portfolio and buy more equities when they’ve fallen to get the portfolio back up to the right level of risk.

During these tempestuous times, one piece of advice would be to try not to look at the news too much. While it’s important to stay informed, it can feel unsettling and is increasingly full of sensationalist speculation and hyperbole. Instead, perhaps take a look at a news site that tries to balance out the regular news with positive news stories that tend to be underreported – Good News Network is a great example of this.

Remember: if you’re sensibly invested in a well-diversified portfolio that matches your risk appetite, don’t let the headlines shake your resolve. Slow and steady wins the race. And if you’re not, it’s time to speak to a good financial planner. Book a call with Goodmans to get started.

This was adapted from an article from one of our partners, Albion Strategic Consulting, with their permission.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.