Sitting out a drop in the markets

For many of our clients, the purpose of accumulating wealth in a portfolio is to provide an income either now or in the future that is, at the very least, able to cover their basic needs, and hopefully a bit more. The level of portfolio-derived income required is unique to each of you. Some will have pensions related to final salary, all will have a state pension and possibly other income from other sources, such as property. Some of you will need to rely more fully on your portfolio.

When markets rise, as they have done most years since the Global Financial Crisis a decade ago, portfolios may even grow after an income has been taken. Happy days! When markets fall, it can begin to feel a little uncomfortable as dividends may be cut and equity values may be down materially, as we have seen in the first quarter of 2020 (the recovery in April has helped a little).

The cardinal sin at these times is to sell equities when they are down, and turn falls into losses. As we set out in our last update, the defensive parts of your portfolio provide the funding for your income and therefore, we can avoid creating losses. Whilst many of you carry enough capital in the defensive part of your portfolio to fund years’ worth of income, it is worth asking ‘How long might I have to do this for?’. Or, put another way, ‘When will the markets return to their previous levels?’.

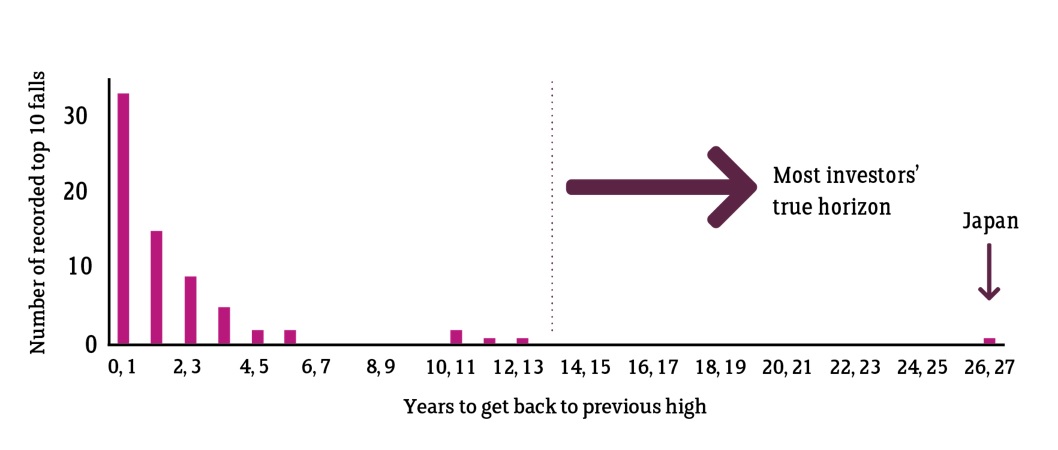

Figure 1 below helps to answer that question. It uses a range of regional (Europe, Asia-Pacific ex-Japan, Emerging and World) and major individual (US, UK, Japan) equity markets, and plots the top 10 largest market falls for each and the time taken to recover back to the previous high, in before-inflation terms.

As you can see, most market falls recover within 1-2 years. However, some may take up to a decade or more, and outliers can and do occur, such as Japan, which took 27 years to recover.

Figure 1: How long will you have to wait?

Data source: Morningstar Direct © All rights reserved.

Data source: Morningstar Direct © All rights reserved.

What is also evident is that, except for Japan, these market falls all sit well within most investment horizons. Whilst Japan provides a salutary lesson that investment outcomes are uncertain, widely diversifying your portfolios helps to remove this country-specific risk.

The question of how much you should hold in defensive assets comes down to how reliant you are on the income from your portfolio. For all, it should be enough to ensure that you can sit out any market fall relatively comfortably, without having to sell down equity positions.

Waiting is not so bad when you know how long the wait might be and you come well prepared to sit it out! Each of you is well prepared and able to sit this out. We wouldn’t have it any other way.